Looking for trillion-dollar opportunities? Take a look at the hydrogen market. This renewable fuel source could become a staple of the global economy in the coming decades. Global consulting firm Deloitte believes it will one day become a trillion-dollar market. McKinsey & Co, another global consultant, predicts that demand for hydrogen will “grow significantly” in the coming years.

Plug-in power supply (NASDAQ: PLUG) is one of the biggest names in the hydrogen industry and many investors are betting on its major upside potential. The potential isn’t hard to calculate, given the company’s paltry $1.8 billion valuation. If long-term demand meets expectations, expect some big hydrogen winners by 2050. But will Plug Power be one of them? The answer may surprise you.

Hydrogen clearly represents a trillion-dollar opportunity

There is no doubt that the hydrogen market itself will grow by leaps and bounds by 2050. That’s because hydrogen is a great option for what economists call hard-to-fight sectors.

While it is relatively easy to replace coal-fired electricity with solar or wind power, certain sectors of the economy – cement and steel production, for example – require the high levels of heat produced by the combustion of fossil fuels. It is unlikely that existing technologies can scale in a way that still supports these crucial industries. That’s where hydrogen technology comes into play. As research from Deloitte concludes: “Decarbonizing sectors that are difficult to decarbonise, such as steelmaking, chemicals, aviation and shipping, will likely require a sixfold increase in global hydrogen use, to almost 600 million tonnes by 2050.”

If this future becomes a reality, Deloitte expects total hydrogen demand to exceed $1.4 trillion by 2050. But growth should pick up much sooner. According to estimates, demand could double between now and 2030, with the total market value reaching $642 billion.

The hydrogen market seems to be a good choice for investors who want to be patient. But is Plug Power stock a good way to capitalize on this decades-long opportunity?

Will Plug Power become a hydrogen winner?

Hydrogen may indeed have enormous long-term promise. But investing in the sector is a completely different challenge. The situation is very similar to that of other capital-intensive renewable energy companies, such as electric vehicles. Although some companies like that Tesla have prospered, countless other start-ups have gone bankrupt. The same will probably apply to hydrogen. Building the necessary infrastructure will require billions in funding, and there is no guarantee that any company’s technology will win out.

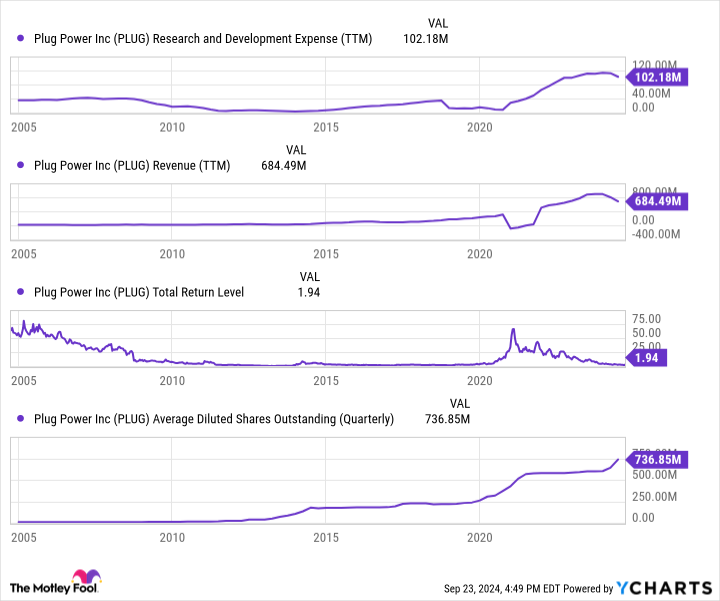

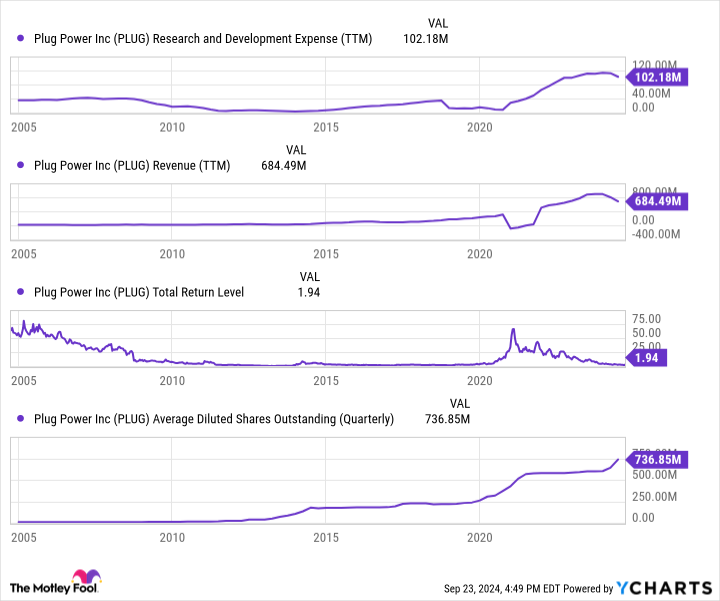

Plug Power’s history over the past 20 years paints this picture well. Sales have picked up, allowing the company to spend more money on research and development. Still, the stock has been a terrible investment over the long term. This is largely due to the dilution of the share. Over the past twenty years, Plug Power’s share count has increased by a whopping 9,950%!

This is the main problem with Plug Power today. Demand for hydrogen will almost certainly increase in the coming decades, even though the exact size and speed of that growth remains highly uncertain. But Plug Power will continue to need billions in new capital to stay competitive. Although it has survived so far thanks to share dilution and government subsidies, which have allowed it to gradually expand its revenue base, the mounting losses have wiped out any potential gains for shareholders.

This problem – that market growth is simply too slow for shareholders to benefit – isn’t going away anytime soon. Goldman Sachs recently estimated that Plug Power has a stock duration of 25.8 years. That figure is intended to represent the weighted average of the company’s expected cash flows. In some ways, Plug Power stock is like buying a bond that doesn’t mature for decades, making the stock price highly sensitive to changes in interest rates and shifts in the competitive environment. Plug Power, for example, could pour billions into its tech stack only if a competitor were to overtake it with a new, cheaper production method.

Can Plug Power Become a Trillion-Dollar Stock by 2050? The answer is almost certainly no. The total market size is expected to be only about $1.4 trillion by 2050. And which companies or technologies will win is impossible to predict at this point. All we know for sure is that investments in competing technologies are increasing just as Plug Power’s research and development budget begins to stagnate.

As late as 2023, Plug Power received a going concern statement from its accountants, warning of possible insolvency if the company failed to raise new capital. These financial stresses won’t go away anytime soon, and further revenue growth will likely be offset by further stock dilution. For now, Plug Power appears poised to survive and potentially become a bigger player in the broader hydrogen market. But investors – even those willing to accept more risk for greater returns – must look elsewhere.

Should you invest €1,000 in Plug Power now?

Consider the following before purchasing shares in Plug Power:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The ten stocks that made the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 23, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Tesla. The Motley Fool has a disclosure policy.

Will plug-in electricity be a billion-dollar share in 2050? was originally published by The Motley Fool

Leave a Comment